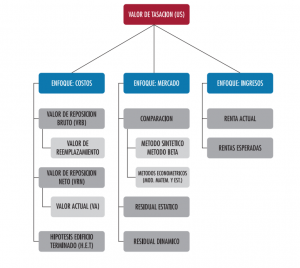

Internationally, three Valuation Approaches are known: COST or REPOSITION, MARKET AND INCOME (INCOME).

Every property must be analyzed using the cost, income and market approaches, considering in its application those particular factors or conditions that influence or can significantly influence the values, reasoning and weighing the valuation results by the approaches used according to of the characteristics,

The approaches are the starting point for the application of Valuation Methods, direct and indirect, that are simply the path that lead us to reach the final objective: the estimation of the Value of the Good that is assessed or Appraisal Value or Current Value which is how they commonly know him.